1. Introduction

This article is the first in a planned series. My goal is to illustrate how J can be used in an actuarial setting. Although I am a J enthusiast, I do not consider myself to be a highly skilled J programmer. I hope that by introducing these actuarial methods to the J community, my programs can be refined and simplified. All feedback is welcome!

All of the methods in this series will be related to property / casualty insurance (e.g. auto, home, workers compensation). I will attempt to explain the methods in an intuitive, informal manner. Readers wishing to follow a rigorous formal treatment are encouraged to consult “Stochastic Claims Reserving Methods in Insurance”[1]. For those readers interested in a “middle ground” textbook (comprehensive, detailed, yet not a formal mathematical treatment with proofs and theorems), “Estimating Unpaid Claims Using Basic Techniques” [2] should be valuable. Not only is [2] freely available online in PDF form, it is also a standard textbook used by the Casualty Actuarial Society for examination purposes.

2. General Description of the Chain Ladder Method

Suppose we have the 10 x 10 array displayed in Figure 1.

357848 1124788 1735330 2218270 2745596 3319994 3466336 3606286 3833515 3901463 352118 1236139 2170033 3353322 3799067 4120063 4647867 4914039 5339085 0 290507 1292306 2218525 3235179 3985995 4132918 4628910 4909315 0 0 310608 1418858 2195047 3757447 4029929 4381982 4588268 0 0 0 443160 1136350 2128333 2897821 3402672 3873311 0 0 0 0 396132 1333217 2180715 2985752 3691712 0 0 0 0 0 440832 1288463 2419861 3483130 0 0 0 0 0 0 359480 1421128 2864498 0 0 0 0 0 0 0 376686 1363294 0 0 0 0 0 0 0 0 344014 0 0 0 0 0 0 0 0 0

Figure 1

Actuaries call this type of array a triangle, for obvious reasons.

This triangle can also be found in Table 1 of “Distribution-free Calculation of the Standard Error of Chain-Ladder Reserve Estimates”[3] (p. 221). Each row can be thought of as an accident year, e.g. the numbers in the top row all relate to auto accidents occurring in the first year. Let’s say the first year is 2004 (10 years ago, as of this writing).

For accidents occurring in 2004, the insurance company paid out $357,848 during 2004. The company paid $1,124,788 in total during 2004-2005, and so on. By the end of 2014, the company paid $3,901,463. Assume, for the sake of argument, that nothing ever gets paid after year ten. In that case, we know that $3,901,463 is the final value for 2004. In actuarial parlance, $3,901,463 is called the ultimate loss for 2004.

What’s the ultimate loss for 2005? We don’t know. The latest information we have is that the company paid $5,339,085 between 2005-2014 for accidents which occurred in 2005. There’s one more year to go before the payments “reach ultimate”, as actuaries say. The ultimate loss must be estimated; we must guess a value for the blank cell to the right of $5,339,085 in the second row. What to do?

You can do all kinds of things. But one simple thing you can do is consider the previous year, 2004. How much was paid out in the tenth year, as a percentage growth? Answer: $3,901,463/$3,833,515=1.018. Using this information, we can estimate that the ultimate loss for 2005 is $5,339,085 x (1.018)= $5,433,719. (Note that I am using the exact value $3,901,463/$3,833,515 in the previous computation; rounding differences will result if you use the rounded value 1.018).

So now we have an ultimate value for 2005: $5,433,719. Ultimately, this is the amount that the company will pay. Since the company has already paid $5,339,085, the amount remaining unpaid is $5,433,719-$5,339,085=$94,634. This amount is called the “reserve”. It’s how much the insurance company should set aside to pay future claims for year 2005, assuming it believes the method result.

This is what a reserving actuary does all day: estimates how much the company needs to set aside as a provision for individual accident years, and in aggregate across all years. It’s a big challenge; many companies have failed after underestimating the required reserves. Many insurance companies have experienced stock price plunges after announcing reserve increases. It’s a challenging task, and even the best possible reserve estimate may prove to be way off the mark as circumstances unfold. The actuary’s responsibility is to calculate a reasonable estimate based on the information known at the time.

Let’s continue our example to build our intuition of this method. What about 2006? $4,909,315 has been paid between 2006-2014 on claims occurring in 2006. We have two years to go! But we know that cumulative payments grow by 1.018 in the final, tenth, year. So we just need to worry about the ninth year. What data do we have?

- For 2004 accidents, payments grew from $3,606,286 to $3,833,515 during the ninth year.

- For 2005 accidents, payments grew from $4,914,039 to $5,339,085 during the ninth year.

We can estimate the ninth year growth factor by calculating a weighted average: ($3,833,515+$5,339,085)/($3,606,286+$4,914,039)=1.077 (rounded; actual value 1.07655…). Since payments will grow an additional 1.018 in year ten, in years nine and ten they’ll cumulatively grow 1.077×1.018=1.096. Thus, the ultimate loss for year 2006 is $4,909,315×1.096=$5,378,826. (See the previous warning about rounding.)

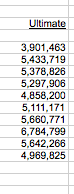

Figure 2

By now you’re probably getting the idea. This process can be carried out iteratively to calculate an ultimate loss for each year. It’s pretty easy to set this up in Excel, which is what most actuaries do. If you use Excel regularly, you might want to try setting up the calculation as an exercise. (The data above can be found in an Excel spreadsheet at the link given in “Mack-Method-handout.xls” [4]). If you do it right, you should get the values displayed in Figure 2.

Two more vocabulary terms. Factors like 1.018 and 1.0177 (i.e. incremental, year-to-year factors) are called Age-to-age or ATA factors. Cumulative factors like 1.096 are called Age to ultimate or ATU factors. Other names are used as well, e.g. link ratios, cumulative development factors (CDF), loss development factors (LDF). They’re all acceptable but some are ambiguous (e.g. link ratio might refer to ATA or ATU factors).

3. Why J?

The Excel approach is easy enough and gets the job done, so who needs J? First, an Excel implementation of the Chain Ladder method can be a hassle to modify if the triangle changes size (say, if you suddenly get twenty years of history instead of ten). What if you have a lot of triangles, of various sizes, and need to quickly calculate the Chain-Ladder ultimate losses for all of them? This is where J shines and Excel falters.

The J code

In general I find it convenient to export triangles into boxes and remove the zero values, because they cause all sorts of headaches. I use the following two functions extensively:

exportboxes=:<"1@({~ i.@#)@|:

removezeros=:(#~(~:&0)) (&.>)See Figure 3 for an illustration. I call our triangle Tri in this example.

,. exportboxes Tri ┌─────────────────────────────────────────────────────────────────────────────── │357848 352118 290507 310608 443160 396132 440832 359480 376686 344014 ├─────────────────────────────────────────────────────────────────────────────── │1124788 1236139 1292306 1418858 1136350 1333217 1288463 1421128 1363294 0 ├─────────────────────────────────────────────────────────────────────────────── │1735330 2170033 2218525 2195047 2128333 2180715 2419861 2864498 0 0 ├─────────────────────────────────────────────────────────────────────────────── │2218270 3353322 3235179 3757447 2897821 2985752 3483130 0 0 0 ├─────────────────────────────────────────────────────────────────────────────── │2745596 3799067 3985995 4029929 3402672 3691712 0 0 0 0 ├─────────────────────────────────────────────────────────────────────────────── │3319994 4120063 4132918 4381982 3873311 0 0 0 0 0 ├─────────────────────────────────────────────────────────────────────────────── │3466336 4647867 4628910 4588268 0 0 0 0 0 0 ├─────────────────────────────────────────────────────────────────────────────── │3606286 4914039 4909315 0 0 0 0 0 0 0 ├─────────────────────────────────────────────────────────────────────────────── │3833515 5339085 0 0 0 0 0 0 0 0 ├─────────────────────────────────────────────────────────────────────────────── │3901463 0 0 0 0 0 0 0 0 0 └───────────────────────────────────────────────────────────────────────────────

,. removezeros @: exportboxes Tri ┌─────────────────────────────────────────────────────────────────────────────── │357848 352118 290507 310608 443160 396132 440832 359480 376686 344014 ├─────────────────────────────────────────────────────────────────────────────── │1124788 1236139 1292306 1418858 1136350 1333217 1288463 1421128 1363294 ├─────────────────────────────────────────────────────────────────────────────── │1735330 2170033 2218525 2195047 2128333 2180715 2419861 2864498 ├─────────────────────────────────────────────────────────────────────────────── │2218270 3353322 3235179 3757447 2897821 2985752 3483130 ├─────────────────────────────────────────────────────────────────────────────── │2745596 3799067 3985995 4029929 3402672 3691712 ├─────────────────────────────────────────────────────────────────────────────── │3319994 4120063 4132918 4381982 3873311 ├─────────────────────────────────────────────────────────────────────────────── │3466336 4647867 4628910 4588268 ├─────────────────────────────────────────────────────────────────────────────── │3606286 4914039 4909315 ├─────────────────────────────────────────────────────────────────────────────── │3833515 5339085 ├─────────────────────────────────────────────────────────────────────────────── │3901463 └───────────────────────────────────────────────────────────────────────────────

Figure 3

Now we’re going to use J’s power to calculate all the ATA factors are once.

NB. numerator of the ATA factor calculation CLnum=: >@:(+/ each @:}.@:removezeros@:exportboxes) NB. denominator of the ATA factor calculation CLden=: >@:(+/ each @:(}:@:(}: each @:(removezeros @: exportboxes)))) CLATA=: CLnum % CLden CLATU=: |.@:(*/\@:(|.@:CLATA))

Figure 4 displays the results of these functions. The ATU factors can be checked against the spreadsheet example given in “Mack-Method-handout.xls” [4], column N (where they are labeled LDF; see section 2 above regarding varied nomenclature).

CLnum Tri

11614543 17912342 21930921 21654971 19828268 17331381 13429640 9172600 3901463

CLden Tri

3327371 10251249 15047844 18447791 17963259 15954957 12743113 8520325 3833515

CLATA Tri

3.49061 1.74733 1.45741 1.17385 1.10382 1.08627 1.05387 1.07656 1.01772

CLATU Tri

14.4466 4.1387 2.36858 1.6252 1.3845 1.25428 1.15466 1.09564 1.01772Figure 4

Now we’ll calculate the ultimate losses. First we define a simple utility function which pulls the diagonal off the triangle, except for the top value (which we’re not going to develop, because it has already reached year ten).

diagona1=: > @: ({: each @: removezeros @: exportboxes)

diagonal Tri

344014 1363294 2864498 3483130 3691712 3873311 4588268 4909315 5339085 3901463Figure 5

To calculate the ultimates, we multiply the diagonal by the ATU factors, and append the fully-developed 2004 value.

CLUltimates=: diagonal * (1,~CLATU)

The reserves are the ultimates minus the diagonal.

CLReserves=: CLUltimates - diagonal

CLUltimates Tri

4.96982e6 5.64227e6 6.7848e6 5.66877e6 5.11117e6 4.8582e6 5.29791e6 5.37883e6

5.43372e6 3.90146e6

(CLUltimates Tri)

5.30389e7

CLReserves Tri

4.62581e6 4.27897e6 3.9283e6 2.17764e6 1.41946e6 984889 789638 469511 94633.8 0

(CLReserves Tri)

1.86889e7Figure 6

The values for the ultimates and reserves can be crosschecked against the spreadsheet example in “Mack-Method-handout.xls”[4] (columns P and O, respectively). The reserves can also be found in the first column of Table 2 of [3], page 221.

4. Conclusion

We have coded J functions, CLUltimates and CLReserves, that allow us to compute the ultimate losses and reserves, according to the Chain Ladder Method, for each year of a loss development triangle. J’s versatility allows us to compute these values for a large number of triangles at once, of various dimensions. A straightforward way to do this would be to organize the triangles into a master array of boxes, one triangle per box, and run the command CLUltimates each triangles (where triangles is the array of boxes).

The Chain Ladder method is one of the most basic methods available to Property / Casualty actuaries. Over the years, many more sophisticated methods have been developed. In future articles I hope to illustrate more of these methods in J.

I welcome all comments regarding this article, and am especially eager to receive suggestions on how the code could be improved.

5. References

- Wüthrich, Mario V., and Michael Merz, “Stochastic Claims Reserving Methods in Insurance,” Wiley Finance, 2008

- Friedland, Jacqueline, “Estimating Unpaid Claims Using Basic Techniques”, Casualty Actuarial Society, 2010

- Mack, Thomas, “Distribution-free Calculation of the Standard Error of Chain-Ladder Reserve Estimates”, ASTIN Bulletin 23/2, 213-225

- https://www.casact.org/education/spring/2006/handouts/Mack-Method-handout.xls